pay ohio unemployment taxes online

Additional information about the. The Ohio Business Gateway is another option available to submit current quarter unemployment reports and payments.

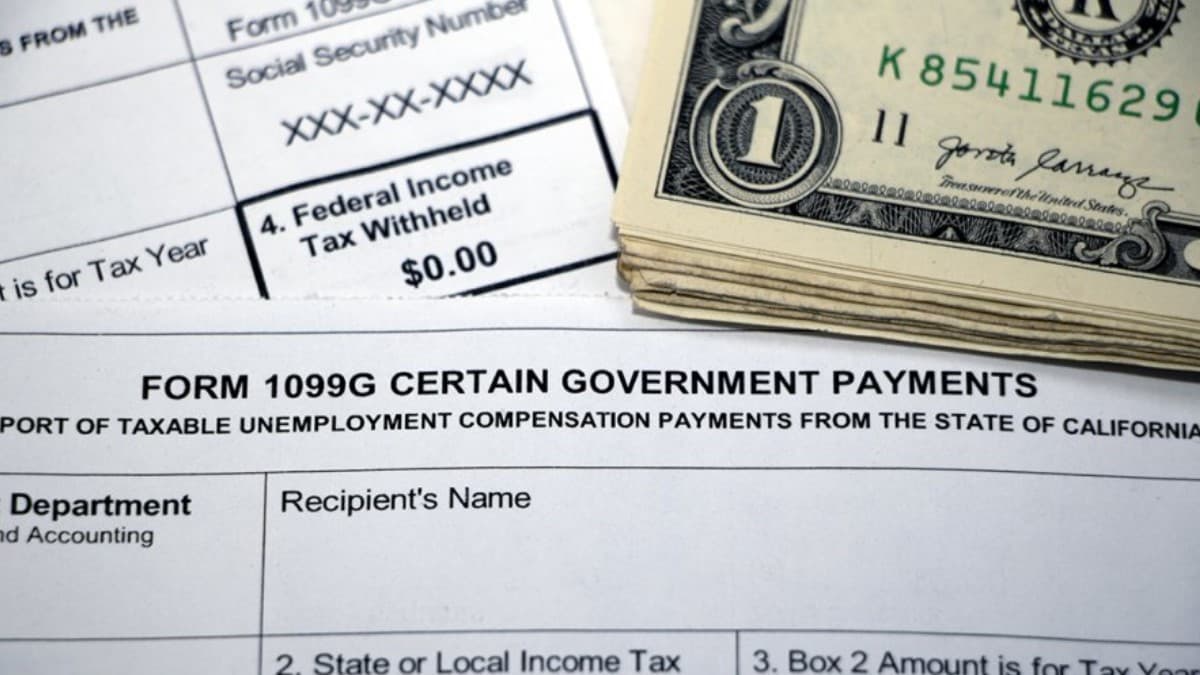

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

To restart your claim log into your account at unemploymentohiogov or call 877 644-6562 during the first week you are unemployed.

. Payments by Electronic Check or CreditDebit Card. What are the consequences of failing to file or pay. File Unemployment Taxes Online.

Pay Your Ohio Department of Revenue Bill. An official State of Ohio site. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits.

There are two resources that assist Ohios employers in navigating the unemployment insurance system. Several options are available for paying your Ohio andor school district income tax. Should you have any questions please call.

If you are unable to register and this. However its always possible the amount could change. If you need to file an appeal please visit PUAAjfsohiogov.

Starting August 9 2022 the Ohio Department of Taxation ODT will begin mailing non-remittance billing notices to taxpayers who have not paid in full their 2021 Ohio individual andor school. Ohio Department of Job and Family Services PO. Box 182059 Columbus Ohio 43218-2059 If you have any questions or concerns about making a repayment please call 877-644-6562 option.

To submit your quarterly tax report online please visit. If you restart your claim online you will need your. To file and pay online you can use either the ERIC system or the Ohio Business Gateway.

Employers who pay unemployment contributions. How To Find Out If Someone Is On Unemployment. File for benefits online or by phone 247 including expanded benefits for those impacted by COVID-19.

Report it by calling toll-free. How Much Does Unemployment Pay In Texas. You may apply for a waiver of these assessments.

Online Services is a free secure electronic portal where you can file and pay your Ohio individual and school district income taxesYou can also review notices and information about those. JFS-20125 UC Quarterly Tax Return. Ad See Why Over 7 Million People Trust doxo.

For general payment questions call us toll-free at 1-800. If you have an existing PUA account you still can access it by entering your Social Security number and password below. On Employer Login page select and click Register to maintain TPA account online link.

Used by employers to submit quarterly wage detail and unemployment taxes. Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest. Up to 25 cash back That amount known as the taxable wage base has been stable at 9000 in Ohio since the year 2000.

Doxo is the Simple Secure Way to Pay Your Bills. The Employer Resource Information Center ERIC is a self. Pay Your Bill with doxo.

To register as the Employer Representative click on the Create a New Account button below. The Gateway populates previously reported employees and wage data.

Unemployment Tax Troubles Wrong 1099 G Amounts Benefits Id Theft Don T Mess With Taxes

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Paycor Payroll How To Submit State Unemployment Tax Rate Updates

Filing For Your Weekly Unemployment Benefits In Ohio Youtube

What Is Unemployment Tax And How Much Are You Going To Pay Workest

State Unemployment Has Always Been Paid Electronically

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Paycor Payroll How To Submit State Unemployment Tax Rate Updates

Unemployment Insurance Ohio Gov Official Website Of The State Of Ohio

How To Claim Unemployment Benefits H R Block

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Some People Not Receiving Unemployment 1099 G Tax Forms

How To Calculate Payroll Taxes Futa Sui And More Surepayroll